QuickLinks-- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantxý |

Filed by a Party other than the Registranto

|

Check the appropriate box:

|

o

|

|

Preliminary Proxy Statement |

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x

ý |

|

Definitive Proxy Statement |

o

|

|

Definitive Additional Materials |

o

|

|

Soliciting Material Pursuant to §240.14a-12

|

Micron Technology, Inc.

|

(Name of Registrant as Specified In Its Charter) |

N/A

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | |

Payment of Filing Fee (Check the appropriate box): |

x

ý |

|

No fee required. |

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1)

| (1) | | Title of each class of securities to which transaction applies:

|

| | |

| (2) | (2)

| Aggregate number of securities to which transaction applies:

|

| | |

| (3) | (3)

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | |

| (4) | (4)

| Proposed maximum aggregate value of transaction:

|

| | |

| (5) | (5)

| Total fee paid:

|

o |

| |

o

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1)

|

(1)

|

|

Amount Previously Paid:

|

| | |

| (2) | (2)

| Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| (3)

| Filing Party:

(4) | | Date Filed:

|

|

| |

| (4)

| Date Filed:

|

| | |

| | |

| |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

Notice of 20062007 Annual Meeting of Shareholders

December 5, 20064, 2007

To the Shareholders:

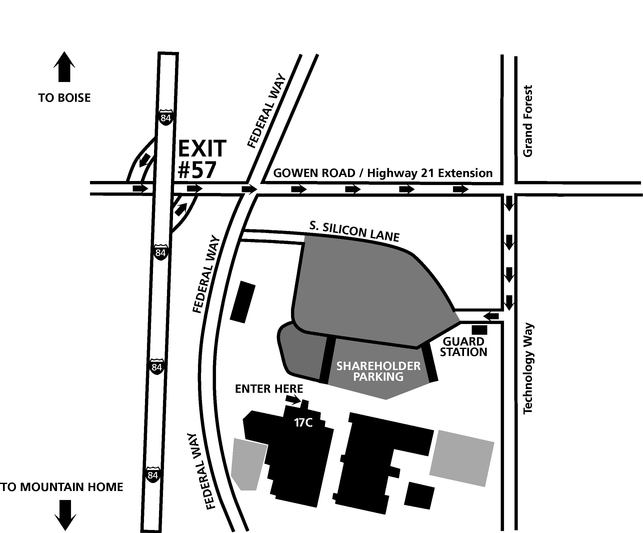

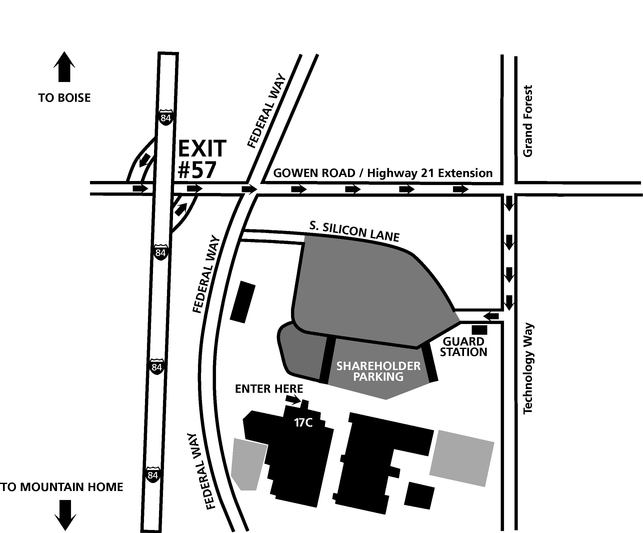

NOTICE IS HEREBY GIVEN thatGIVENthat the 20062007 Annual Meeting of Shareholders of Micron Technology, Inc., a Delaware corporation (the “Company”"Company"), will be held on December 5, 2006,4, 2007, at 9:00 a.m., Mountain Standard Time, at the Company’sCompany's headquarters located at 8000 South Federal Way, Boise, Idaho 83716-9632, for the following purposes:

To elect directors to serve for the ensuing year and until their successors are elected and qualified;

2.To approve an amendment to the Company’s 2004Company's 2007 Equity Incentive Plan increasing the number ofwith 30,000,000 shares reserved for issuance thereunder by 30,000,000;thereunder;

3.To ratify the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm of the Company for the fiscal year ending August 30, 2007;28, 2008; and

4. To act upon a shareholder proposal, if properly presented at the meeting; and5.

To transact such other business as may properly come before the meeting or any adjournment thereof.The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only shareholders of record at the close of business on October 11, 2006,10, 2007, are entitled to notice of and to vote at the meeting. A complete list of shareholders entitled to vote at the meeting will be open to the examination of any shareholder, for any purpose germane to the business to be transacted at the meeting, during ordinary business hours for the ten-day period immediately preceding the date of the meeting, at the Company’sCompany's headquarters at 8000 South Federal Way, Boise, Idaho 83716-9632.

Attendance at the Annual Meeting will be limited to shareholders and guests of the Company. Shareholders may be asked to furnish proof of ownership of the Company’sCompany's Common Stock before being admitted to the meeting. Directions to the meeting’smeeting's location accompany the Proxy Statement.

To ensure your representation at the meeting, you are urged to vote, sign, date and return the enclosed proxy as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Alternatively, shareholders may vote by telephone or electronically via the internet. Please refer to the instructions included with the proxy for additional details. Shareholders attending the meeting may vote in person even if they have already submitted their proxy.

| By Order of the Board of Directors |

|

Roderic W. Lewis

|

|

Vice President of Legal Affairs,

|

|

General Counsel & Corporate Secretary

|

Boise, Idaho

| |

November 8, 2006

| |

Boise, Idaho

November 5, 2007

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY PROMPTLY.

8000 South Federal Way

Boise, Idaho 83716-9632

PROXY STATEMENT

2006

2007 ANNUAL MEETING OF SHAREHOLDERS

December 5, 20064, 2007

9:00 a.m. Mountain Standard Time

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors of Micron Technology, Inc. (the “Company”"Company"), for use at the 20062007 Annual Meeting of Shareholders to be held on December 5, 2006,4, 2007, at 9:00 a.m., Mountain Standard Time, or at any adjournment or postponement thereof (the “Annual Meeting”"Annual Meeting"). The purposespurpose of the Annual Meeting areis set forth herein and in the accompanying Notice of 20062007 Annual Meeting of Shareholders. The Annual MeetingMeeting will be held at the Company’sCompany's headquarters located at 8000 South Federal Way, Boise, Idaho 83716-9632. Directions to the Annual Meeting accompany this Proxy Statement. The Company’sCompany's telephone number is (208) 368-4000.

This Proxy Statement and enclosed proxy card are first being distributed on or about November 8, 2006,5, 2007, to all shareholders entitled to vote at the meeting.

Record Date

Shareholders of record at the close of business on October 11, 200610, 2007 (the “Record Date”"Record Date") are entitled to notice of and to vote at the meeting.

Revocability of Proxy

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by attending the Annual Meeting and voting in person or by delivering to the Company a written notice of revocation or another duly executed proxy bearing a date later than the earlier given proxy.

Solicitation

The cost of solicitation will be borne by the Company. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may be solicited by the Company’sCompany's directors, officers and employees, without additional compensation, personally or by telephone internet or facsimile.internet. The Company intends to use the services of Georgeson, Inc., a proxy solicitation firm, in connection with the solicitation of proxies. Although the exact cost of the solicitation services is not known at this time, it is anticipated that the fees and expenses paid by the Company for these services will be approximately $15,000.

VOTING SECURITIES AND PRINCIPAL HOLDERS$30,000.

Outstanding Shares

The Company has one class of stock outstanding, common stock, $.10 par value per share (the “Common Stock”"Common Stock"). At October 11, 2006,10, 2007, the Record Date, 754,379,515757,931,820 shares of Common Stock were issued and outstanding and entitled to vote.

Voting Rights and Required Vote

Under the Delaware General Corporation Law and the Company’sCompany's Restated Certificate of Incorporation and its Bylaws, each shareholder will be entitled to one vote for each share of the Company’sCompany's Common Stock held at the Record Date for all matters, including the election of directors, unless cumulative voting for the election of directors is required. The required quorum for the transaction of business at the Annual Meeting is a majority of the votes eligible to be cast by holders of shares of the Company’sCompany's Common Stock issued and outstanding on the Record Date. Shares that are voted “FOR,” “AGAINST”"FOR," "AGAINST" or “ABSTAIN”"ABSTAIN" and, with respect to the election of directors, “WITHHOLD”"WITHHOLD" or “DO"DO NOT VOTE FOR,”" are treated as being present at the Annual Meeting for the purposes of establishing a quorum and are tallied to determine the shareholders’shareholders' decision with respect to the matter voted upon (the “Votes Cast”"Votes Cast"). Abstentions will have the same effect as voting against a proposal. Broker non-votes will be considered present and entitled to vote for purposes of determining the presence or absence of a quorum for the transaction of business, but such non-votes are not deemed to be Votes Cast and, therefore, will not be included in the tabulation of the voting results with respect to voting results for the election of directors or issues requiring the approval of a majority of Votes Cast.

Shares held in a brokerage account or by another nominee are considered held in “street name”"street name" by the shareholder or “beneficial"beneficial owner.”" A broker or nominee holding shares for a beneficial owner may not vote on matters relating to equity compensation plans unless the broker or nominee receives specific voting instructions from the beneficial owner of the shares. As a result, absent specific instructions, brokers or nominees may not vote a beneficial owner’sowner's shares on Proposal 2 and such shares will be considered “broker non-votes”"broker non-votes" for such proposal.

The seven nominees for director receiving the highest number of “FOR”"FOR" votes will be elected, regardless of whether any one of them receives the vote of a majority of the Votes Cast. With respect to each other item of business, the “FOR”"FOR" vote of a majority of the Votes Cast is required in order for such matter to be considered approved by the shareholders. Abstentions and broker non-votes will not count as Votes Cast “FOR” any nominee or proposal.

Cumulative voting for the election of directors shall not be required unless a shareholder has requested cumulative voting by written notice to the Secretary of the Company at least 15 days prior to the date of the meeting. If cumulative voting is required, with respect to the election of directors, each voting shareholder may cumulate such shareholder’sshareholder's votes and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of votes to which the shareholder’sshareholder's shares are entitled, or distribute the shareholder’sshareholder's votes among as many candidates as the shareholder thinks fit, provided that votes cannot be cast for more than seven candidates. If cumulative voting is required, the persons authorized to vote shares represented by proxies shall have the authority and discretion to vote such shares cumulatively for any candidate or candidates for whom authority to vote has not been withheld.

Voting of Proxies

The shares of the Company’sCompany's Common Stock represented by all properly executed proxies received in time for the meeting will be voted in accordance with the directions given by the shareholders.If no

instructions are given withwith respect to a properly executed Proxy timely received by the Company, the shares of the Company’sCompany's Common Stock represented thereby will be voted (i) FOR each of the nominees named herein as directors, or their respective substitutes as may be appointed by the Board of Directors, (ii) FORapproval of an amendment to the Company’s 2004Company's 2007 Equity Incentive Plan increasing the number ofwith 30,000,000 shares reserved for issuance thereunder, by 30,000,000, (iii) FOR ratification of the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm of the Company for the fiscal 2007, (vi) AGAINST the shareholder proposal,year ended August 28, 2008, and (vii)(iv) in the discretion of the proxy holders for such other matter or matters which may properly come before the Annual Meeting.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth security ownership information of the Company’s Common Stock as of the Record Date (October 11, 2006), based on the most current information provided to the Company by the beneficial owners, available to the Company from its own records or provided in Securities and Exchange Commission (“SEC”) filings made by the beneficial owners, for (i) persons known by the Company to own beneficially more than 5% of the Company’s Common Stock, (ii) each director, (iii) each Named Executive Officer listed in the “Summary Compensation Table” set forth herein, and (iv) all directors and executive officers as a group:

Name and Address of Beneficial Owner | | | | Number of

Shares Owned(1) | | Right to Acquire(2) | | Total | | Percent of

Class(3) | |

Brandes Investment Partners, L.P.(4) | | | 72,947,753 | | | | — | | | 72,947,753 | | | 9.7 | % | |

11988 El Camino Real, Suite 500

San Diego, CA 92130 | | | | | | | | | | | | | | | |

CAM North America, LLC(5) | | | 46,595,972 | | | | — | | | 46,595,972 | | | 6.2 | % | |

399 Park Avenue

New York, NY 10022 | | | | | | | | | | | | | | | |

Capital Research and Management | | | | | | | | | | | | | | | |

Company(6) | | | 38,619,120 | | | | — | | | 38,619,120 | | | 5.1 | % | |

333 South Hope Street | | | | | | | | | | | | | | | |

Los Angeles, CA 90071-1406 | | | | | | | | | | | | | | | |

PrimeCap Management(7) | | | 56,664,206 | | | | — | | | 56,664,206 | | | 7.5 | % | |

225 South Lake Ave, Ste. 400

Pasadena, CA 91101-3005 | | | | | | | | | | | | | | | |

Teruaki Aoki | | | — | | | | 4,375 | | | 4,375 | | | | | |

Steven R. Appleton(8) | | | 1,168,466 | | | | 2,780,000 | | | 3,948,466 | | | * | | |

James W. Bagley | | | 22,583 | | | | 94,613 | | | 117,196 | | | * | | |

D. Mark Durcan(9) | | | 432,453 | | | | 1,590,000 | | | 2,022,453 | | | * | | |

Robert J. Gove | | | 181,979 | | | | 809,500 | | | 991,479 | | | * | | |

Mercedes Johnson | | | 24,505 | | | | 17,500 | | | 42,005 | | | * | | |

Roderic W. Lewis | | | 255,853 | | | | 1,590,000 | | | 1,845,853 | | | * | | |

Robert A. Lothrop(10) | | | 111,871 | | | | 106,933 | | | 218,804 | | | * | | |

Lawrence N. Mondry | | | 20,083 | | | | 17,500 | | | 37,583 | | | * | | |

Gordon C. Smith(11) | | | 39,877 | | | | 41,000 | | | 80,877 | | | * | | |

Wilbur G. Stover, Jr.(12) | | | 216,980 | | | | 1,357,000 | | | 1,573,980 | | | * | | |

Robert E. Switz | | | 16,958 | | | | 4,375 | | | 21,333 | | | * | | |

William P. Weber(13) | | | 96,431 | | | | 60,000 | | | 156,431 | | | * | | |

All directors and executive officers as a group (20 persons) | | | 3,768,498 | | | | 13,292,781 | | | 17,061,279 | | | 2.2 | % | |

* Represents less than 1% of shares outstanding

(1) Excludes shares that may be acquired through the exercise of outstanding stock options. For the Company’s officers and directors, includes shares of restricted stock subject to time-based and/or performance-based restrictions. For information on the restricted stock held by the Named Executive Officers, see the Summary Compensation Table on page 10. For information on the restricted stock held by the Company’s non-employee directors, see the table on page 14.

(2) Represents shares that an individual has a right to acquire within 60 days of October 11, 2006.

(3) For purposes of calculating the Percent of Class, shares that the person or entity had a Right to Acquire are deemed to be outstanding when calculating the Percent of Class of such person or entity, but are not deemed to be outstanding for the purpose of calculating the Percent of Class of any other person or entity.

(4) Brandes Investment Partners have shared voting power as to 60,974,655 shares. They have shared dispositive power as to 72,947,753 shares. This information is taken from a Schedule 13G dated February 14, 2006.

(5) Includes shares held by CAM North America LLC and its affiliates, Salomon Brothers Asset Management Inc., Smith Barney Fund Management LLC and TIMCO Asset Management Inc. CAM North America, LLC has shared voting power as to 23,845,680 shares and shared dispositive power as to 29,305,242 shares. Salomon Brothers Asset Management has shared voting power as to 274,202 shares and shared dispositive power as to 274,202 shares. Smith Barney Fund Management LLC has shared voting power as to 16,665,618 shares and shared dispositive power as to 16,665,618 shares. TIMCO Asset Management Inc. has shared voting power as to 350,910 shares and shared dispositive power as to 350,910 shares. This information was taken from a Schedule 13G dated February 14, 2006.

(6) Capital Research Management has sole voting power as to 23,590,000 shares and sole dispositive power as to 38,619,120 shares. This information is taken from a Schedule 13G dated February 6, 2006.

(7) PrimeCap Management Company has sole voting power as to 7,494,696 shares and sole dispositive power as to 56,664,206 shares. This information was taken from a Schedule 13G dated February 8, 2006.

(8) Includes 20,000 shares beneficially owned by Mesa L.P.

(9) Includes 84,507 shares held by C & E Partners L.P. and 3,101 shares beneficially owned by Mr. Durcan’s spouse.

(10) Includes 82,464 shares beneficially owned in joint tenancy with Mr. Lothrop’s spouse and 848 shares beneficially owned by Mr. Lothrop’s spouse. Mr. Lothrop has announced his retirement from the Company’s Board of Directors effective at the close of the 2006 Annual Meeting of Shareholders.

(11) Includes 26,338 shares beneficially owned by G.C. Smith LLC.

(12) Includes 3,900 shares beneficially owned by Mr. Stover’s minor children.

(13) Mr. Weber has announced his retirement from the Company’s Board of Directors effective at the close of the 2006 Annual Meeting of Shareholders.

BUSINESS TO BE TRANSACTED

PROPOSAL 1. ITEM 1—ELECTION OF DIRECTORS

Nominees

The Company’sCompany's Bylaws currently authorize a Board of Directors comprised of nineseven members. A board of seven directors is to be elected at the Annual Meeting, all of whom have been recommended for nomination by a majority of the independent directors of the Board of Directors and all of whom are currently serving as directors of the Company. Robert A. Lothrop and William P. Weber are not standing for reelection as they have announced that they are retiring from the Company’s Board of Directors effective at the close of the 2006 Annual Meeting. Immediately following the Annual Meeting, the Company’s Bylaws will be amended to provide for a Board of Directors comprised of seven members. Unless otherwise instructed, the proxy holders will vote the proxies received by them for management’smanagement's seven nominees named below, all of whom are presently directors of the Company. Your proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement. If any management nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. It is not expected that any nominee listed below will be unable or will decline to serve as a director. The term of office of each person elected as a director will continue until the next Annual Meeting of Shareholders or until such person’sperson's successor has been elected and qualified, except in the case of earlier resignation or removal. Officers are appointed annually by the Board of Directors and serve until their successors are duly chosenappointed and qualified, except in the case of earlier resignation or removal. The names of the seven nominees and certain information about them are set forth below:

| | | | | | Served as a | | Board Committees* | | |

| |

| |

| | Board Committees*

|

|---|

Name of Nominee

| | |

| |

| | Served as a

Director Since

|

|---|

| Age | | Principal Occupation | | Director Since | | A | | C | | G | | | Age

| | Principal Occupation

| | A

| | C

| | G

|

|---|

Teruaki Aoki | | | 65 | | | President, Sony University and Managing

Director, Sony Foundation for Education | | | 2006 | | | | | | | | X | | | | X | | | | 66 | | Executive Managing Director of Sony Foundation for Education | | 2006 | | | | X | | X |

Steven R. Appleton | | | 46 | | | Chairman, Chief Executive Officer and

President of the Company | | | 1994 | | | | | | | | | | | | | | | | 47 | | Chairman and Chief Executive Officer of the Company | | 1994 | | | | | | |

James W. Bagley | | | 67 | | | Executive Chairman of Lam Research

Corporation | | | 1997 | | | | | | | | | | | | | | | | 68 | | Executive Chairman of Lam Research Corporation | | 1997 | | | | | | |

| Robert L. Bailey | | | 50 | | Chairman, President and Chief Executive Officer of PMC-Sierra, Inc. | | 2007 | | X | | | | X |

Mercedes Johnson | | | 52 | | | Senior Vice President and Chief Financial

Officer of Avago Technologies Limited | | | 2005 | | | | X | | | | | | | | X | | | | 53 | | Senior Vice President and Chief Financial Officer of Avago Technologies Limited | | 2005 | | | | | | |

Lawrence N. Mondry | | | 46 | | | Former Chief Executive Officer, CompUSA, Inc. | | | 2005 | | | | | | | | X | | | | X | | | | 47 | | President and Chief Executive Officer of CSK Auto Corporation | | 2005 | | X | | X | | X |

Gordon C. Smith | | | 77 | | | Chairman and Chief Executive Officer of

SFG LLC | | | 1990 | | | | X | | | | | | | | X | | | |

Robert E. Switz | | | 60 | | | President and Chief Executive Officer of

ADC Telecommunications, Inc. | | | 2006 | | | | X | | | | | | | | X | | | | 61 | | President and Chief Executive Officer of ADC Telecommunications, Inc. | | 2006 | | X | | | | X |

- *

A = Audit Committee, C = Compensation Committee, G = Governance Committee

Mr. Weber is currently a member of the Compensation Committee. Mr. Weber has announced his retirement from the Company’s Board of Directors effective at the close of the 2006 Annual Meeting of Shareholders. Following Mr. Weber’s retirement, another director will be appointed to the Compensation Committee.

Set forth below are the principal occupations of the nominees for at least the past five years:

Teruaki Aoki is President of Sony University andExecutive Managing Director of Sony Foundation for Education. Dr. Aoki has been associated with Sony since 1970 and has held various executive positions, including Senior Executive Vice President and Executive Officer of Sony Corporation as well as President and Chief Operating Officer of Sony Electronics, a U.S. subsidiary. Dr. Aoki holds a Ph.D. in Material Sciences from Northwestern University as well as a BS in Applied Physics from the University of Tokyo. He was elected as an IEEE Fellow in 2003 and serves as Advisory Board Member of Kellogg School of Management of Northwestern University. Dr. Aoki also serves on the board of Citizen Holdings Co. Ltd. Dr. Aoki is the Chairman of the Board's Governance Committee.

Steven R. Appleton joined the Company in February 1983 and has served in various capacities with the Company and its subsidiaries. Mr. Appleton first became an officer of the Company in August 1989 and has served in various officer positions with the Company since that time. From April 1991 until July 1992 and since May 1994, Mr. Appleton has served on the Company’sCompany's Board of Directors. SinceFrom September 1994 to June 2007, Mr. Appleton has served as the Chief Executive Officer, President and Chairman of the Board of Directors of the Company. In June 2007, Mr. Appleton relinquished his position as President of the Company but retained his positions of Chief Executive Officer and Chairman of the Board. Mr. Appleton is a member of the Board of Directors of National Semiconductor Corporation. Mr. Appleton holds a BA in Business Management from Boise State University.

James W. Bagley became the Executive Chairman of Lam Research Corporation (“Lam”("Lam"), a supplier of semiconductor manufacturing equipment, in June 2005. From August 1997 through June 2005, Mr. Bagley served as the Chairman and Chief Executive Officer of Lam. Mr. Bagley is a member of the Board of Directors of Teradyne, Inc. He has served on the Company’sCompany's Board of Directors since June 1997. Mr. Bagley holds a MS and BS in Electrical Engineering from Mississippi State University.

Robert L. Bailey has served as the President and Chief Executive Officer of PMC-Sierra, a leading provider of broadband communication and storage semiconductor solutions for the next-generation Internet, since July 1997. He has been Chairman of the Board since May 2005 and was also Chairman from February 2000 until February 2003. Mr. Bailey has been a director of PMC since October 1996. Mr. Bailey has served as President, Chief Executive Officer and director of PMC-Sierra, Ltd., PMC's Canadian operating subsidiary ("LTD") since December 1993. Mr. Bailey was employed by AT&T-Microelectronics from August 1989 to November 1993, where he served as Vice President and General Manager, and by Texas Instruments in management from June 1979 to August 1989. Mr. Bailey holds a BS degree in Electrical Engineering from the University of Bridgeport and an MBA from the University of Dallas.

Mercedes Johnson has served as the Senior Vice President and Chief Financial Officer of Avago Technologies Limited, a semiconductor company, since December 2005. Prior to that, she served as the Senior Vice President, Finance, of Lam from June 2004 to January 2005 and as Lam’sLam's Chief Financial Officer from May 1997 to May 2004. Before joining Lam, Ms. Johnson spent 10 years with Applied Materials, Inc., where she served in various senior financial management positions, including vice presidentVice President and worldwide operations controller.Worldwide Operations Controller. Ms. Johnson holds a degree in accounting from the University of Buenos Aires and currently serves on the Board of Directors for Intersil Corporation. Ms. Johnson isserved as the Chairman of the Board’sBoard's Audit Committee.Committee in fiscal 2007.

Lawrence N. Mondry currently serves as the President and Chief Executive Officer of CSK Auto Corporation, ("CSK"), a specialty retailer of automotive aftermarket parts. Prior to his appointment at CSK, Mr. Mondry served as the Chief Executive Officer of CompUSA Inc. from November 2003 to May 2006. Mr. Mondry joined CompUSA in 1990 as Senior Vice President and General Merchandise Manager. He was promoted to Executive Vice President-Merchandising in 1993, and President and Chief Operating Officer of CompUSA Stores in 2000.1990. Mr. Mondry currently serves on the Board of Directors for Golfsmith, Inc.of CSK. Mr. Mondry is the Chairman of the Board’sBoard's Compensation Committee.

Gordon C. SmithRobert E. Switz has served as the Chairmanis currently President and Chief Executive Officer of SFG LLC, a holding company for agriculture operations and other investments, since January 2005. Mr. Smith has also served as Chairman and Chief Executive Officer of G.C. Smith LLC since May 2000. From July 1980 to March 1994, Mr. Smith served in various management positions with J.R. Simplot Company, including four years as President and Chief Executive Officer, and seven years as Chief Financial Officer. From February 1982 until February 1984 and since September 1990, he has served on the Company’s Board of Directors. Mr. Smith holds a BS in Accounting from Idaho State University.

Robert E. Switz is currently President and CEO of ADC Telecommunications, Inc., ("ADC"), a supplier of network infrastructure products and services. Mr. Switz has been with ADC since 1994 and prior to his current position, served ADC as Executive Vice President and Chief Financial Officer. Mr. Switz holds an MBA from the University of Bridgeport as well as a degree in marketing/economics from Quinnipiac

University. Mr. Switz also serves on the Board of Directors for ADC and Broadcom Corporation. Mr. Switz is the Chairman of the Board’sBoard's Audit Committee and served as the Chairman of the Board's Governance Committee.Committee in fiscal 2007.

There is no family relationship between any director or executive officer of the Company.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) During portions of fiscal 2007, Robert A. Lothrop, Gordon C. Smith and William P. Weber served as members of the SecuritiesCompany's Board of Directors.

Code of Business Conduct and Exchange ActEthics

The Board of 1934 (the “Exchange Act”) requires the Company’sDirectors has adopted a Code of Business Conduct and Ethics that is applicable to all directors, and executive officers and persons who own beneficially more than 10%employees of the Common StockCompany. A copy of the Micron Code of Business Conduct and Ethics is available on the Company's website at www.micron.com/code and is also available in print upon request. Any amendments or waivers of the Code of Business Conduct and Ethics will also be posted on the Company's website within four business days of the amendment or waiver as required by applicable rules and regulations of the SEC and NYSE Listing Requirements.

Director Independence

Under current NYSE rules, a director only qualifies as "independent" if the Company's Board of Directors affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company). A director is not independent under Section 303A.02(b) of the NYSE List Company Manual if:

- •

- The director is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company.

- •

- The director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $100,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service).

- •

- (A) The director or an immediate family member is a current partner of a firm that is the Company's internal or external auditor; (B) the director is a current employee of such a firm; (C) the director has an immediate family member who is a current employee of such a firm and who participates in the firm's audit, assurance or tax compliance (but not tax planning) practice; or (D) the director or an immediate family member was within the last three years (but is no longer) a partner or employee of such a firm and personally worked on the Company's audit within that time.

- •

- The director or an immediate family member is, or has been within the last three years, employed as an executive officer of another Company where any of the Company's present executive officers at the same time serves or served on that company's compensation committee.

- •

- The director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to,

file reportsor received payments from, the listed company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company's consolidated gross revenues.

The guidelines provide that ownership and changes of ownershipa significant amount of the Company's stock, by itself, does not constitute a material relationship with the SecuritiesCompany. For relationships not covered by the guidelines set forth above, the determination of whether a material relationship exists is made by the other members of the Company's Board of Directors who are independent.

As of October 31, 2007, the Company's Board of Directors has determined that each of Messrs. Bailey, Mondry, Switz, and Exchange Commission andDr. Aoki is "independent" within the New York Stock Exchange (“NYSE”). Copiesmeaning of all filed reports are required to be furnished toSection 303A.02(b) of the NYSE Listed Company Manual. Each of these directors has no relationship with the Company, pursuant to Section 16(a)other than any relationship that is categorically not material under the guidelines shown above and other than as disclosed in this Proxy Statement under "Compensation of the Exchange Act. Based solely on the reports received by the CompanyDirectors" and on written representations from reporting persons, the Company believes that the directors, executive officers, and greater than 10% beneficial owners complied with all applicable filing requirements during the fiscal year ended August 31, 2006.

Certain"Certain Relationships and Related TransactionsTransactions."

During fiscal 2006, the Company paid $89.2 million to Lam Research Corporation (“Lam”) for semiconductor manufacturing equipment and related services. The Company also received approximately $174,000 from Lam for the sale of used equipment in fiscal 2006. Mr. Bagley is the current Executive Chairman of Lam.

During fiscal 2006, the Grove Hotel and Qwest Arena in Boise, Idaho, received approximately $284,000 for business conducted with the Company. The Company uses the Grove Hotel for business visitors and conferences, and leases a suite for events at the Qwest Arena. Mr. Appleton has an interest in a limited liability company that is a minority owner of the Grove Hotel and Qwest Arena.

From the beginning of fiscal 2006 until February 15, 2006, Intel Corporation (“Intel”) held stock rights exchangeable into at least 5% of the Company’s outstanding Common Stock. During the period in which Intel held at least 5% of the Company’s Common Stock, the Company received $110.7 million from Intel Corporation for purchases of the Company’s semiconductor memory products. In fiscal 2006, the Company also made payments of approximately $112,000 to Intel for purchases of products.

In January 2006, IM Flash Technologies (“IMFT”), a joint venture between the Company and Intel, began operations. IMFT manufactures NAND Flash memory products for the exclusive benefit of its partners. In connection with the formation of IMFT, the Company contributed land and facilities in Lehi, Utah, a fully paid lease of a portion of the Company’s manufacturing facility in Manassas, Virginia, a wafer supply agreement to be supported by the Company’s operations located in Boise, Idaho, and $250 million in cash. The aggregate fair value of these contributions was $1.245 billion. Intel contributed $1.196 billion in cash and notes to IMFT. As a result of these contributions, the Company owns 51% and Intel owns 49% of IMFT. The results of IMFT are included in the consolidated financial statements of the Company.

IMFT manufactures NAND Flash memory products based on NAND Flash designs developed by the Company and Intel and licensed to the Company. In the second quarter of 2006, the Company received net proceeds of $230 million from Intel for the sale of the Company’s existing NAND Flash memory designs and certain related technology and the Company’s acquisition of a perpetual, paid-up license to use and modify such designs.

Board Meetings and Committees

The Board of Directors of the Company held sevenfive meetings during fiscal 2006.2007. The Board of Directors met in Executive Session five times during fiscal 2007. In fiscal 2006,2007, the Board of Directors had a standing Audit Committee, and a standing Governance Committee and Compensation Committee. During fiscal 2006,2007, the Audit Committee met eleventwelve times, the Compensation Committee met two times and the Governance and

Compensation Committee met three times.once. In addition to formal committee meetings, the chairmen of the committees engaged in regular discussions with management regarding various issues relevant to their respective committees. All incumbent directors attended 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings of all committees of the Board on which they served, during fiscal 2006. All incumbent2007. Eight directors except Dr. Aoki and Mr. Switz attended the Company’sCompany's Annual Meeting of Shareholders in 2005. Dr. Aoki and Mr. Switz did not become directors until after the 2005 Annual Meeting.2006.

In September 2006, the Board of Directors separated the Governance and Compensation Committee into two distinct committees, a Governance Committee and a Compensation Committee. The Audit Committee, the Governance Committee and the Compensation Committee each have written charters that comply with federal and NYSE rules relating to corporate governance matters. Copies of the committee charters as well as the Company’sCompany's Corporate Governance Guidelines are available on the Company’sCompany's website at www.micron.com.www.micron.com and are also available in print upon request. The Board has determined that all the members of the Audit Committee, the Governance Committee, and the Compensation Committee satisfy the independence requirements of applicable federal laws and the listing standards of the NYSE for such committees.

Ms. Johnson and Messrs. SmithBailey, Mondry and Switz currently serve on the Audit Committee. Throughout fiscal 2006,On October 31, 2007, Mr. Lothrop also served onSwitz was named Chairman of the Audit Committee and Mr. Bailey was appointed to the Audit Committee. Ms. Johnson isserved as the Chairman of the Audit Committee.Committee throughout fiscal 2007 and until the appointment of Mr. Switz. The Board has determined that Ms. Johnson and Messrs. SmithBailey, Mondry and Switz each qualifies as an “audit"audit committee financial expert”expert" for purposes of the rules and regulations of the Securities and Exchange Commission. Each member of the Audit Committee is independent within the meaning of the NYSE listing requirements applicable to members of a listed company’s audit committee. The purpose of the Audit Committee is to assist the Board in overseeing and monitoring (i) the integrity of the Company’sCompany's financial statements, (ii) the performance of the Company’sCompany's internal audit function and its Independent Registered Public Accounting Firm, (iii) the qualifications and independence of the Company’sCompany's Independent Registered Public Accounting Firm, and (iv) the Company’sCompany's compliance with legal and regulatory requirements. The Audit Committee is also responsible for preparing the Audit Committee report that is included in the Company’sCompany's annual Proxy Statement. See “Report"Report of the Audit Committee of the Board of Directors.”" The complete duties and responsibilities of the Audit Committee are set forth in its written charter, which is available at www.micron.com and is also attachedavailable in print upon request to corporatesecretary@micron.com. A copy of the Audit Committee charter was included as Appendix Aan appendix to thisthe Company's 2006 Proxy Statement.

Dr. Aoki, Ms. Johnson and Messrs. Bailey, Mondry Smith,and Switz and Weber currently serve on the Governance Committee. Mr. SwitzDr. Aoki is the Chairman of the Governance Committee. Each member of the Committee is independent within the meaning of the NYSE listing requirements applicable to members of a listed company’s nominating/corporate governance committee. The responsibilities of the Governance Committee include assisting the Board in discharging its duties with respect to (i) the identification and selection of nominees to the Company’sCompany's Board of Directors and (ii) the development of Corporate Governance Guidelines for the Company. The complete duties and responsibilities of the Governance Committee are set forth in its written charter, which is available at www.micron.com.www.micron.com and is also available in print upon request to corporatesecretary@micron.com.

The Governance Committee is responsible for identifying nominees for the Company’sCompany's Board of Directors. There are no minimum qualifications that nominees must possess buthowever the following factors are strongly considered by the Governance Committee in making its recommendations: substantial experience in the semiconductor industry or related industries; strong business acumen and judgment;

excellent interpersonal skills; business relationships with key individuals in industry, government and education that may be of significant assistance to the Company and its operations; familiarity with accounting rules and practices; and “independence”"independence" as defined and required by NYSE Listing Application Standards and relevant rules and regulations of the SEC. In fiscal 2006, the Board of Directors determined that it would

be advisable to add additional members to the Board. To that end, the Governance Committee works with a third party executive search firm to assist them in the identification and evaluation of potential candidates to the Company’sCompany's Board of Directors. As a result of the Governance Committee’sCommittee's efforts and the executive search firm’sfirm's efforts, Dr. Aoki and Mr. Switz were added to the Company’sCompany's Board of Directors in 2006. It is currently anticipated that additional candidates will join the Company’sCompany's Board of Directors in fiscal 2007.2008.

The Governance Committee will consider director nominee recommendations from shareholders. Shareholder recommendations are subject to the same criteria used to evaluate other candidates. Shareholders wishing to recommend a prospective nominee should submit the candidate’scandidate's name and qualifications to the Company’sCompany's Corporate Secretary at corporatesecretary@micron.com. The Company’sCompany's Bylaws contain the provisions that address the process by which a shareholder may actually nominate an individual to stand for election to the Company’sCompany's Board of Directors. A copy of the Company’sCompany's Bylaws can be found on the Corporate Governance page of its website at www.micron.com.www.micron.com and is available in print upon request to corporatesecretary@micron.com. During fiscal 2006,2007, the Company received nodid not receive any director nominations from shareholders.

Dr. Aoki and Messrs. Mr. Mondry and WeberDr. Aoki currently serve on the Compensation Committee of the Board of Directors. Mr. Mondry is the Chairman of the Compensation Committee. Mr. Weber has announced his retirement from the Company’s Board of Directors effective at the close of the 2006 Annual Meeting. Following Mr. Weber’s retirement, another director will be appointed to the Compensation Committee. Each member of the Committee is independent within the meaning of the NYSE listing requirements applicable to the listed company’s compensation committee. The Compensation Committee is responsible for reviewing and approving the compensation of the Company’sCompany's officers. See “Reportthe "Compensation Discussion and Analysis" and the "Report of the Compensation Committee ofon Executive Compensation" for information how the Board of Directors Regarding Executive Compensation.”Compensation Committee sets executive compensation levels. The complete duties of the Compensation Committee are set forth in its written charter, which is available at www.micron.com.www.micron.com and is also available in print upon request to corporatesecretary@micron.com.

The Board of Directors meets regularly in executive sessions in which only non-employee directors are present. On September 26, 2006,October 9, 2007, Mr. WeberBagley was appointedreappointed to preside at these executive sessions for fiscal 2007.2008. He has served as presiding director since September 2002. Shareholders and interested parties wishing to communicate with the Company’sCompany's Board of Directors may contact Mr. WeberBagley at presidingdirector@micron.com. A new presiding director will be appointed after Mr. Weber’s retirement from

COMPENSATION OF DIRECTORS

The Governance Committee of the Board of Directors oversees the setting of compensation for the Company's non-employee members of its Board of Directors. Information on howIn fiscal 2007, the Governance Committee worked with Mercer (formerly Mercer Human Resources Consulting, Inc.), an outside compensation consultant, to contact Mr. Weber’s successor will be available onreview and evaluate director compensation in light of prevailing market conditions. Mercer gathered compensation data from the Corporate Governance pageCompany's custom peer group of companies as well as from the 2006 Mercer Study of 350 large US public companies. (For a discussion of the Company’s website at www.micron.com.

Codepeer group of Business Conductcompanies, please see the Compensation Discussion and Ethics

TheAnalysis.) In September 2006, as a result of this evaluation, the Board of Directors has adopted a Codeapproved the Governance Committee's recommendation that they:

- •

- Replace the annual stock option grant with an award of

Business Conduct and Ethics that is applicable to all directors, officers and employeesrestricted stock.

- •

- Determine the amount of the

Company. A copyannual restricted stock award on a pre-determined dollar value as opposed to a targeted number of shares.

- •

- Provide for immediate vesting of director equity awards upon termination due to retirement.

- •

- Increase the cash retainer for the Chair of the

Micron Code of Business Conduct and Ethics is available onAudit Committee from $10,000 to $15,000.

- •

- Increase the

Company’s website at www.micron.com/code. Any amendments or waivers of the Code of Business Conduct and Ethics will also be posted on the Company’s website within four business days of the amendment or waiver as required by applicable rules and regulations of the SEC and NYSE listing requirements.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

The following table summarizes compensation earned by the Company’s Chief Executive Officer and the Company’s other four most highly compensated executive officers during fiscal 2006 (collectively, the “Named Executive Officers”) for all services rendered to the Company and its subsidiaries for each of the last three completed fiscal years:

SUMMARY COMPENSATION TABLE

| | | | Annual Compensation | | Long-Term Compensation | |

| | | | | | | | Restricted | | Options | | All Other | |

| | Fiscal | | | | Stock | | Granted | | Compensation | |

Name and Principal Position | | | | Year | | Salary(1) | | Bonus | | Award(2) | | (3) | | (4) | |

Steven R. Appleton(5) | | | 2006 | | | $ | 903,754 | | $ | 1,010,746 | | $ | 3,778,900 | | 0 | | | $ | 65,871 | | |

Chairman, CEO & President | | | 2005 | | | 845,962 | | 542,680 | | 851,900 | | 420,000 | | | 78,471 | | |

| | | 2004 | | | 600,000 | | 686,311 | | 0 | | 600,000 | | | 260,870 | | |

D. Mark Durcan(6) | | | 2006 | | | 435,212 | | 314,971 | | 1,978,050 | | 0 | | | 7,289 | | |

Chief Operating Officer | | | 2005 | | | 382,981 | | 211,813 | | 425,950 | | 130,000 | | | 6,909 | | |

| | | 2004 | | | 347,386 | | 515,178 | | 0 | | 250,000 | | | 128,645 | | |

Robert J. Gove(7) | | | 2006 | | | 328,324 | | 491,022 | | 1,036,150 | | 0 | | | 43,128 | | |

Vice President of Imaging Group | | | 2005 | | | 307,981 | | 340,733 | | 243,400 | | 110,000 | | | 6,909 | | |

| | | 2004 | | | 281,821 | | 455,103 | | 0 | | 200,000 | | | 1,500 | | |

Roderic W. Lewis(8) | | | 2006 | | | 366,722 | | 264,219 | | 1,158,050 | | 0 | | | 26,157 | | |

Vice President of Legal Affairs, | | | 2005 | | | 348,789 | | 251,465 | | 304,250 | | 130,000 | | | 18,645 | | |

General Counsel & Corporate Secretary | | | 2004 | | | 325,219 | | 509,972 | | 0 | | 250,000 | | | 140,199 | | |

Wilbur G. Stover, Jr.(9) | | | 2006 | | | 437,304 | | 314,101 | | 1,158,050 | | 0 | | | 35,529 | | |

Vice President of Finance & | | | 2005 | | | 413,789 | | 298,083 | | 243,400 | | 130,000 | | | 13,294 | | |

CFO | | | 2004 | | | 385,985 | | 477,584 | | 0 | | 225,000 | | | 171,026 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

(1) Includes compensation deferred by the named executive under the Company’s 401(k) retirement plan.

(2) Restricted stock was awarded on September 30, 2005, to Messrs. Appleton, Durcan, Gove, Lewis and Stover in the amounts of 310,000, 95,000, 85,000, 95,000 and 95,000 shares, respectively. In addition, Mr. Durcan was awarded 50,000 shares of restricted stock on February 13, 2006. Restricted stock was awarded on November 19, 2004, to Messrs. Appleton, Durcan, Gove, Lewis and Stover in the amounts of 70,000, 35,000, 20,000, 25,000 and 20,000 shares, respectively. All restricted stock was awarded under the Company’s 2004 Equity Incentive Plan (“the 2004 Plan.”). The value of the restricted stock reported in this column was determined by usingannual equity award from $184,200 to $225,000.

- •

- Leave the

fair market value ofannual retainer unchanged at $50,000.

In October 2007, the Company’s Common Stock onGovernance Committee reviewed the date of grant, as defined under the 2004 Plan. Under the 2004 Plan, “fair market value” equals the average closing price of the Company’s Common Stock on the last trading day priorCompany's director compensation practices with Mercer and concluded that changes to the date of grant. The aggregate value (based on $17.28 per share, the average closing price of the Company’s Common Stock on August 31, 2006) of the restricted shares held by the Named Executive Officers as of August 31, 2006 was as follows: Mr Appleton, $6,163,189; Mr Durcan, $2,908,794; Mr. Gove, $1,699,194; Mr. Lewis, $1,929,588; and Mr. Stover, $1,871,994. The restrictions associated with the shares granted to the Named Executive Officers include both time-based restrictions and performance-based restrictions. Time-based restrictions lapse in three equal installments over a three-year period from the date of the award. Any dividends payable with respect to the Company’s Common Stock will be payable with respect to all awards of restricted stock reported in this column.

(3) Includes options to purchase shares of the Company’s Common Stock that were granted under the Company’s 2001 Stock Option Plan (the “2001 Plan”). Options granted under the 2001 Plan generally vest over four years and have a term ranging from six to ten years. Options granted under the 2001

Plan have an exercise price equal to the fair market value on the date of grant. Under the 2001 Plan “fair market value” equals the average closing price of the Company’s Common Stock on the last trading day prior to the date of grant.

(4) Amounts for 2006 and 2005 for all Named Executive Officers include Company contributions in the amounts of $7,289 and $6,909, respectively, under the Company’s 401(k) retirement plan. Amounts for 2004 for all Named Executive Officers, except Mr. Appleton, include Company contributions in the amount of $1,500 under the Company’s 401(k) retirement plan.

(5) Salary amounts for Mr. Appleton for 2004 reflect the fact that from October 28, 2001 through December 4, 2003, he elected not to receive a salary. Bonuses for 2006 and 2005 include awards under the Executive Officer Performance Incentive Plan in the amounts of $979,110 and $517,688, respectively, and profit distribution of $31,636 and $24,992, respectively. Bonus amounts for 2004 reflect an executive officer bonus award of $671,458 and profit distribution of $14,853. All Other Compensation for 2006 and 2005 includes payments under the Company’s time-off plan for time accrued in excess of 999 hours totaling $58,582 and $71,563, respectively. All Other Compensation for 2004 includes executive bonuses previously earned but unpaid with respect to fiscal 1997 performance of $211,908, payments under the Company’s time-off plan for time accrued in excess of 999 hours totaling $45,962 and Company contributions in the amount of $3,000 under the Company’s 401(k) retirement plan.

(6) Mr. Durcan’s bonus for 2006 and 2005 includes awards under the Executive Officer Performance Incentive Plan in the amounts of $299,182 and $197,667, respectively, and profit distribution of $15,789 and $11,562 respectively. Bonus amounts for 2004 reflect an executive officer bonus award of $503,593, profit distribution of $6,835 and patent bonuses totaling $4,750. All Other Compensation for 2004 includes executive bonuses previously earned but unpaid with respect to fiscal 1997 performance of $127,145.

(7) Mr. Gove’s bonus for 2006 and 2005 includes awards under the Executive Officer Performance Incentive Plan in the amounts of $279,196 and $281,337, respectively, and profit distribution of $11,825 and $9,396, respectively. Mr. Gove also received performance bonuses in 2006, 2005 and 2004 in the amounts of $200,000, $50,000 and $80,000, respectively. Bonus amounts for 2004 reflect an executive officer bonus award of $369,302, profit distribution of $5,468 and a patent bonus of $333. All Other Compensation for 2006 includes payments under the Company’s time-off plan for time accrued in excess of 999 hours totaling $35,839.

(8) Mr. Lewis’ bonus for 2006 and 2005 includes awards under the Executive Officer Performance Incentive Plan in the amounts of $251,027 and $240,913, respectively, and profit distribution of $13,192 and $10,552, respectively. Bonus amounts for 2004 reflect an executive officer bonus award of $503,593 and profit distribution of $6,379. All Other Compensation for 2006 and 2005 includes payments under the Company’s time-off plan for time accrued in excess of 999 hours totaling $18,868 and $11,736, respectively. All Other Compensation for 2004 includes executive bonuses previously earned but unpaid with respect to fiscal 1997 performance of $127,145, and payments under the Company’s time-off plan for time accrued in excess of 999 hours totaling $11,554.

(9) Mr. Stover’s bonus for 2006 and 2005 includes awards under the Executive Officer Performance Incentive Plan in the amounts of $298,518 and $285,654, respectively, and profit distribution of $15,583 and $12,429, respectively. Bonus amounts for 2004 reflect executive officer bonus award of $470,000 and profit distribution of $7,563. All Other Compensation for 2006 and 2005 includes payments under the Company’s time-off plan for time accrued in excess of 999 hours totaling $28,240 and $6,385, respectively. All Other Compensation for 2004 includes executive bonuses previously earned but unpaid with respect to fiscal 1997 performance of $169,526.

11

OPTION GRANTS IN LAST FISCAL YEAR

Optionsprogram were not granted to the Named Executive Officers in fiscal 2006.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table provides information regarding option exercises in fiscal 2006 by the Named Executive Officers and the value of such officers’ unexercised options at August 31, 2006:

| | Number of

Shares | | | | Number of

Unexercised

Options at Fiscal

Year-End | | Value of Unexercised

In-The-Money

Options

at Fiscal

Year-End(2) | |

Name | | | | Acquired on

Exercise | | Value

Realized(1) | | Exercisable (E)

Unexercisable (U) | | Exercisable (E)

Unexercisable (U) | |

Steven R. Appleton | | | 0 | | | | $ | 0 | | | | 2,780,000 | (E) | | | $ | 4,634,500 | (E) | |

| | | | | | | | | | | 20,000 | (U) | | | 162,400 | (U) | |

D. Mark Durcan | | | 0 | | | | 0 | | | | 1,590,000 | (E) | | | 2,050,670 | (E) | |

| | | | | | | | | | | 10,000 | (U) | | | 81,200 | (U) | |

Robert J. Gove | | | 35,000 | | | | 195,650 | | | | 809,500 | (E) | | | 963,400 | (E) | |

| | | | | | | | | | | 7,500 | (U) | | | 60,900 | (U) | |

Roderic W. Lewis | | | 0 | | | | 0 | | | | 1,590,000 | (E) | | | 2,050,670 | (E) | |

| | | | | | | | | | | 10,000 | (U) | | | 81,200 | (U) | |

Wilbur G. Stover, Jr. | | | 150,000 | | | | 697,090 | | | | 1,357,000 | (E) | | | 962,853 | (E) | |

| | | | | | | | | | | 10,000 | (U) | | | 81,200 | (U) | |

| | | | | | | | | | | | | | | | | | | | | |

(1) Represents the amount equal to the excess of the fair market value of the shares at the time of exercise over the exercise price of the options.warranted.

(2) Represents the difference between the exercise priceElements of the options and $17.28, the closing price reported by Bloomberg L.P. of the Company’s Common Stock on August 31, 2006.Director Compensation

Annual Retainer.

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of August 31, 2006, regarding Common Stock that may be issued pursuant to the Company’s equity compensation plans:

| | (a)

Number Of Securities To Be

Issued Upon Exercise Of

Outstanding Options,

Warrants And Rights | | (b)

Weighted-Average Exercise

Price Of Outstanding

Options, Warrants And

Rights | | (c)

Number Of Securities

Remaining Available For

Future Issuance Under Equity

Compensation Plans (Excluding

Securities Reflected In Column

(a)) | |

Equity Compensation Plans Approved by Shareholders(1) | | | 87,578,321 | | | | $ | 20.72 | | | | 27,962,925 | (2) | |

Equity Compensation Plans Not Approved by Shareholders(3)(4) | | | 36,384,882 | | | | 18.29 | | | | 13,930,847 | | |

Totals | | | 123,963,203 | | | | 20.01 | | | | 41,893,772 | | |

(1) Includes shares issuable upon settlement or exercise of restricted stock units and options granted pursuant to the Company’s 1994 Stock Option Plan, 2001 Stock Option Plan, 2004 Equity Incentive

Plan, 1996 Lexar Plan and 2000 Lexar Equity Incentive Plan and rights under the 1998 Director’s Stock Incentive Plan. Plans associated with Lexar were assumed by the Company in connection with its acquisition of Lexar Media, Inc. in June 2006.

(2) Awards under the 2004 Equity Incentive Plan include restricted stock and restricted stock units. Includes 2,743,690 shares reserved for issuance under the Company’s Employee Stock Purchase Plan.

(3) Includes shares issuable upon exercise of options granted pursuant to the Company’s Nonstatutory Stock Option Plan, 1998 Nonstatutory Stock Option Plan, 1997 Nonstatutory Stock Option Plan and the 2002 Employee Inducement Stock Option Plan. Options granted under the aforementioned plans have terms ranging from six to ten years. The exercise price and the vesting schedule of the options granted under the Nonstatutory Plans are determined by the administrators of the plans or the Company’s Board of Directors. Directors do not participate in the aforementioned plans and executive officers do not participate once they become executive officers.

(4) Does not include 16,761 shares issuable upon exercise of options with a weighted-average exercise price of $6.05 outstanding under the Rendition 1994 Equity Incentive Plan. This plan was assumed by the Company in connection with its acquisition of Rendition, Inc. in September 1998. Does not include 43,302 shares issuable upon exercise of options with a weighted-average exercise price of $0.87 outstanding under the Micron Quantum Devices (“MQD”) 1996 Stock Option Plan. This plan was assumed by the Company in connection with the merger of MQD (a former subsidiary of the Company) into the Company in February 1998.

Compensation of Directors

Directors who are employees of the Company receive no additional or special remuneration for their service as directors. Directors who are not employees of the Company are entitled to receive an annual retainer of $50,000. Pursuant to the Company’sCompany's 1998 Non-Employee Director’sDirector's Stock Incentive Plan (“DSIP”("DSIP"), non-employee directors may elect to take some or all of their annual retainer in the form of cash, shares of Common Stock or deferred rights to receive Common Stock upon termination as a director. During the period from October 1, 20052006 to October 1, 2006,2007, Ms. Johnson and Mr. Smith received 3,6375,272 shares and 1,093224 shares, respectively, of Common Stock under the DSIP. During the same period, Mr. Bagley deferred rights to receive 3,330the receipt of 4,056 shares of Common Stock under the DSIP. Directors who are employees of the Company receive no additional or special remuneration for their service as directors.

The Company also reimburses directors for travel and lodging expenses, if any, incurred in connection with attendance at Board of Directors’Directors' meetings. The chairman of the Audit Committee receives $15,000 per year for service as committee chair. The chairman of the Governance Committee and the Compensation Committee each receive $10,000 per year for their services as committee chair. Except for the foregoing, directors do not receive any additional or special remuneration for their service on any of the committees established by the Board of Directors.

Mr. Lothrop has entered into an agreement with the Company pursuant to which his receipt of the director fees he earned prior to January 1999 is deferred until the first business day of the calendar year in which he no longer serves as a director of the Company. Deferred amounts, in the case of his termination of service as a director, are paid in five annual installments. In the event of death, the balance then owed is paid in a single sum as soon as practicable following death. All amounts deferred are recorded as a liability in the records of the Company. Such amounts accrue interest monthly at a rate equal to the Company’s average investment portfolio yield for such month.

Non-employee members of the Board of Directors receive an annual equity award from the Company. Prior to fiscal 2005, these equity awards were comprised exclusively of options to purchase the Company’s Common Stock. In fiscal 2005, the composition of the annual equity award was changed to include both stock options and shares of restricted stock, with non-employee directors receiving options to purchase 7,500 shares of Common Stock and 2,500 shares of restricted stock. In fiscal 2006, the restricted stock component of the annual equity award was increased to 7,500 shares; the option component remained

unchanged. Stock options awarded to the non-employee directors are fully vested and have an exercise price equal to the fair market value, as defined by the applicable option plan, of the Company’s Common Stock. For purposes of the Company’s option plans, “Fair Market Value” equals the average closing price of the Company’s Common Stock on the last trading day prior to the date of grant. The restrictions associated with the restricted stock awarded prior to fiscal 2007 to non-employee directors lapse over one or two years and upon retirement from the Company’s Board of Directors.

Equity Award.In fiscal 2007, the directors established a “targeted value”"targeted value" for annual non-employee director compensation was established as opposed to a set number of shares of equity. Following a discussion of relevant data with outside professional consultants,Mercer, the Board determined that such targeted value should be $225,000. Based on this amount for fiscal 2007, the Board approved an award of 12,583 shares of restricted Common Stock to each of the directors, derived by dividing the targeted value of $225,000 by the Fair Market Value, (asas defined above) per shareunder the Company's equity plans, of restrictedthe Company's Common Stock. For purposes of the Company's equity plans, "Fair Market Value" equals the average closing price of the Company's Common Stock on the last trading day prior to the date of grant. The restrictions on the shares awarded for fiscal 2007 will lapse as to 50% of such shares on the first anniversary of the date of grant and the remaining 50% as of the second anniversary of the date of grant (the “Vesting Period”"Vesting Period"). Notwithstanding the foregoing, the restrictions as to the fiscal 2007 shares will lapse as to 100% of such shares in the event a director either reaches the

mandatory retirement age during the Vesting Period or retires from the Board during the Vesting Period having achieved a minimum of three years of service with the Board of Directors prior to the effective date of his or her retirement.

Upon their appointmentDirector Summary Compensation

The following table details the total compensation earned by the Company's non-employee directors in fiscal 2007.

Name

| | Fees Earned

or Paid in

Cash

| | Stock

Awards(1)

| | All Other

Compensation

| | Total

|

|---|

| Teruaki Aoki | | $ | 50,000 | | $ | 139,867 | | $ | 4,426 | (2) | $ | 194,293 |

| James W. Bagley | | | 50,026 | | | 260,174 | | | — | | | 310,200 |

| Mercedes Johnson | | | 63,596 | | | 153,824 | | | — | | | 217,420 |

| Lawrence N. Mondry | | | 59,375 | | | 171,715 | | | — | | | 231,090 |

| Robert E. Switz | | | 59,375 | | | 139,867 | | | — | | | 199,242 |

| Robert A. Lothrop(3) | | | 13,172 | | | 231,440 | | | — | | | 244,612 |

| Gordon C. Smith(3) | | | 46,886 | | | 231,440 | | | — | | | 278,326 |

| William P. Weber(3) | | | 14,005 | | | 231,440 | | | — | | | 245,445 |

- (1)

- On September 26, 2006, each director who was not an employee of the company was granted 12,583 shares of restricted stock with a grant date fair value of $224,984 ($17.88 per share). Amount shown is the expense recognized in the Company's financial statements for fiscal 2007 under Statement of Financial Accounting Standards ("SFAS") No. 123(R), "Share-Based Payments," related to each director's outstanding restricted stock. The expense shown for these stock awards is based solely on the stock price as of the date of grant, disregarding any assumptions as to estimated forfeitures based on continued service. For information on the restrictions associated with these awards, see "Elements of Director Compensation—Equity Awards" above. Specific amounts expensed for each director vary as a result of the director's holdings, length of service and age. Any dividends payable with respect to the

Company’sCompany's Common Stock will be payable with respect to all awards of restricted stock. The total number of restricted shares and options held as of August 30, 2007 for each non-employee director was as follows:

Name

| | Restricted Stock

| | Options*

|

|---|

| Teruaki Aoki | | 14,771 | | 4,375 |

| James W. Bagley | | 15,083 | | 72,000 |

| Mercedes Johnson | | 15,083 | | 17,500 |

| Lawrence N. Mondry | | 15,083 | | 17,500 |

| Robert E. Switz | | 14,771 | | 4,375 |

- *

- All options are fully vested and exercisable.

- (2)

- Reflects amount incurred to cover tax services provided by Deloitte Touche Tohmatsu Japan.

- (3)

- Messrs. Lothrop and Weber resigned from the Board of Directors

Dr. Aokieffective December 5, 2006. Mr. Smith resigned from the Board of Directors on July 25, 2007. Messrs. Lothrop, Weber and Mr. Switz received equity awards proratedSmith did not hold any options or restricted stock at August 30, 2007.

ITEM 2—APPROVAL OF 2007 EQUITY INCENTIVE PLAN

The 2007 Equity Incentive Plan was adopted by the Board of Directors on October 9, 2007, with 30,000,000 shares reserved for issuance thereunder. As of October 10, 2007, there were approximately 19,600 employees eligible to reflect their anticipated service forparticipate in the remainder2007 Equity Incentive Plan. Officers are not eligible to participate in the 2007 Equity Incentive Plan.

A summary of the year. As a resultplan is set forth below. This summary is qualified in its entirety by the full text of these initialthe plan, which is attached to this Proxy Statement as Appendix A.

Purpose

The purpose of the plan is to promote the Company's success by linking the personal interests of its employees, non-employee directors and consultants to those of the Company's shareholders, and by providing participants with an incentive for outstanding performance. Officers of the Company are not eligible to participate in the plan.

Permissible Awards. The plan authorizes the grant of awards Dr. Aoki received restricted stock units for 4,375 shares and optionsin any of the following forms:

- •

- Options to purchase

4,375 shares of Common Stock, which may be nonstatutory stock options or incentive stock options under the U.S. Internal Revenue Code of 1986, as amended (the "Code"). The exercise price of an option granted under the plan may not be less than the fair market value of the Company's Common Stock on the date of grant.

- •

- Stock appreciation rights, which give the holder the right to receive the excess, if any, of the fair market value of one share of Common Stock on the date of exercise, over the base price of the stock appreciation right.

- •

- Performance shares, which are units valued by reference to a designated number of shares of Common Stock upon the attainment of performance goals set by the Compensation Committee of the Board of Directors (the "Committee").

- •

- Restricted stock, which is subject to restrictions on transferability and

Mr. Switz received 4,375subject to forfeiture on terms set by the Committee.

- •

- Restricted stock units, which represent the right to receive shares of Common Stock (or an equivalent value in cash or other property) in the future, based upon the attainment of stated vesting or performance goals set by the Committee.

- •

- Deferred stock units, which represent the right to receive shares of Common Stock (or an equivalent value in cash or other property) in the future, generally without any vesting or performance restrictions.

- •

- Dividend equivalent rights, which entitle the participant to payments in cash or property calculated by reference to the amount of dividends paid on the shares of stock underlying an award.

- •

- Other stock-based awards in the discretion of the Committee, including unrestricted stock grants.

- •

- Any other right or interest relating to Stock.

All awards will be evidenced by a written award certificate between the Company and the participant, which will include such provisions as may be specified by the Committee.

Shares Available for Awards

Subject to adjustment as provided in the plan, the aggregate number of shares of Common Stock reserved and available for issuance pursuant to awards granted under the plan is 30,000,000. The maximum number of shares that may be issued to one person upon exercise of incentive stock options granted under the plan is 2,000,000.Each share issued pursuant to "full value" awards, such as restricted stock, unrestricted

stock, restricted stock units, deferred stock units, performance shares, or other stock-based awards payable in stock, reduces the number of shares available for grant by two shares.

Limitations on Awards

The maximum number of shares of Common Stock that may be covered by options and stock appreciation rights granted under the plan to any one person during any one calendar year is 2,000,000. The maximum number of shares of Common Stock that may be granted under the plan in the form of restricted stock, restricted stock units, deferred stock units, performance shares or other stock-based awards under the plan to any one person during any one calendar year is 2,000,000.

Administration

The plan will be administered by the Committee. The Committee will have the authority to designate participants; determine the type or types of awards to be granted to each participant and the number, terms and conditions thereof; establish, adopt or revise any rules and regulations as it may deem advisable to administer the plan; and make all other decisions and determinations that may be required under the plan. The Board of Directors may at any time administer the plan. If it does so, it will have all the powers of the Committee under the plan.

In addition, the Board or the Committee may expressly delegate to a special committee some or all of the Committee's authority, within specified parameters, to grant awards to eligible participants who, at the time of grant, are not officers.

Deductibility under Section 162(m)

The 2007 Equity Incentive Plan is designed to comply with Code Section 162(m) so that grants of market-priced options and stock appreciation rights under the plan, and other awards that are conditioned on performance goals as described below, will be excluded from the calculation of annual compensation for purposes of Code Section 162(m) and will be fully deductible. While the Committee believes it is important to purchase 4,375preserve the deductibility of compensation under Code Section 162(m) generally, the Board and the Committee reserve the right to grant or approve awards or compensation that is non-deductible.

Performance Goals

The Committee may designate any award as a qualified performance-based award in order to make the award fully deductible without regard to the $1,000,000 deduction limit imposed by Code Section 162(m). If an award is so designated, the Committee must establish objectively determinable performance goals for the award. Performance goals for such awards shall be based on one or more of the following financial, strategic and operational business criteria:

- •

- gross and/or net revenue (including whether in the aggregate or attributable to specific products)

- •

- cost of Goods Sold and Gross Margin

- •

- costs and expenses, including Research & Development and Selling, General & Administrative expenses

- •

- income (gross, operating, net, etc.)

- •

- earnings, including before interest, taxes, depreciation and amortization (whether in the aggregate or on a per share basis

- •

- cash flows and share price

- •

- return on investment, capital, equity

- •

- manufacturing efficiency (including yield enhancement and cycle time reductions), quality improvements and customer satisfaction

- •

- product life cycle management (including product and technology design, development, transfer, manufacturing introduction, and sales price optimization and management)

- •

- economic profit or loss

- •

- market share

- •

- employee retention, compensation, training and development, including succession planning

- •

- objective goals consistent with the Participant's specific duties and responsibilities, designed to further the financial, operational and other business interests of the Company, including goals and objectives with respect to regulatory compliance matters.

In order to meet the requirements of Section 162(m), the Committee must establish such goals within the first 90 days after the beginning of the period for which such performance goal relates (or such other time as may be required or permitted under applicable tax regulations) and the Committee may not increase any award or, except in the case of certain qualified terminations of employment, waive the achievement of any specified goal. Mid-term adjustments of a performance target are permitted only in the case of a corporate transaction or other event of the type that triggers an adjustment in stock based awards (as discussed below under "Adjustments").

The Committee may determine that any evaluation of performance will include, exclude or otherwise equitably adjust for unusual and non-recurring financial events such as asset write-downs or impairment charges; litigation or claim judgments or settlements; the effect of changes in tax laws or accounting principles affecting reported results; accruals for reorganization and restructuring programs; extraordinary nonrecurring items meriting special accounting treatment, as determined under generally accepted accounting principles; acquisitions or divestitures; and foreign exchange gains and losses. However, in order to meet the requirements of Section 162(m), in the event the Committee determines to include or exclude such unusual and nonrecurring events when measuring actual results, it must do so within the first 90 days after the beginning of the period for which such performance goal relates (or such other time as may be required or permitted under applicable tax regulations). Any payment of an award granted with performance goals will be conditioned on the written certification of the Committee in each case that the performance goals and any other material conditions were satisfied.

Limitations on Transfer; Beneficiaries